Single Touch Payroll (STP)

Ensuring compliance and streamlining your STP reporting obligations.

Simplifying your Payroll Compliance with Wrkr

At Wrkr, we understand that managing payroll can be complex, especially with the management of Single Touch Payroll (STP). Our STP service is designed to simplify your payroll processes, ensuring compliance with Australian regulations while streamlining your reporting obligations.

What is Single Touch Payroll (STP)?

Single Touch Payroll is an Australian Government initiative that requires employers to report their employees’ payroll information to the Australian Taxation Office (ATO) in real time. This includes details such as wages, tax withheld, and superannuation contributions. With Wrkr’s STP service, you can effortlessly meet your reporting requirements and reduce the administrative burden on your HR and payroll teams.

Key Features of Wrkr’s STP Service

Real-Time Reporting

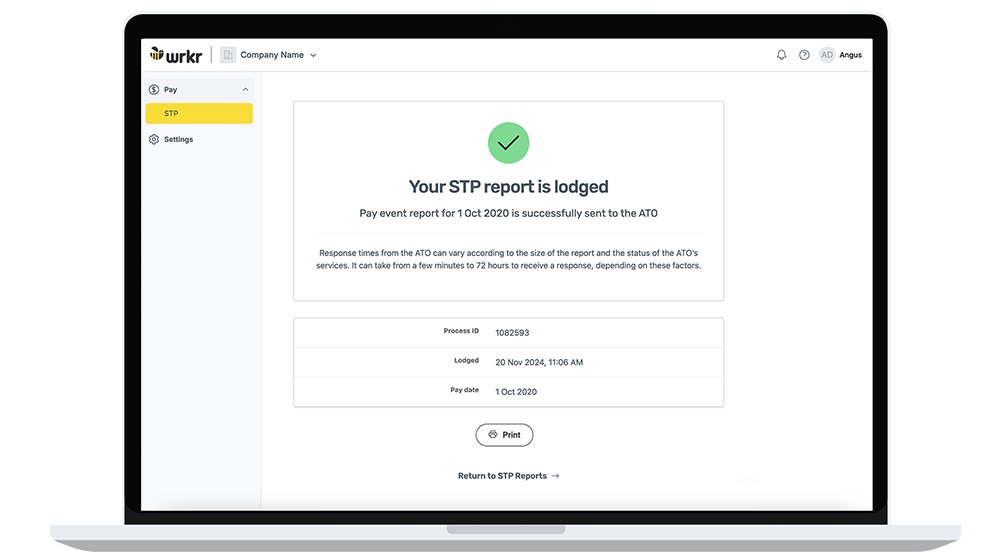

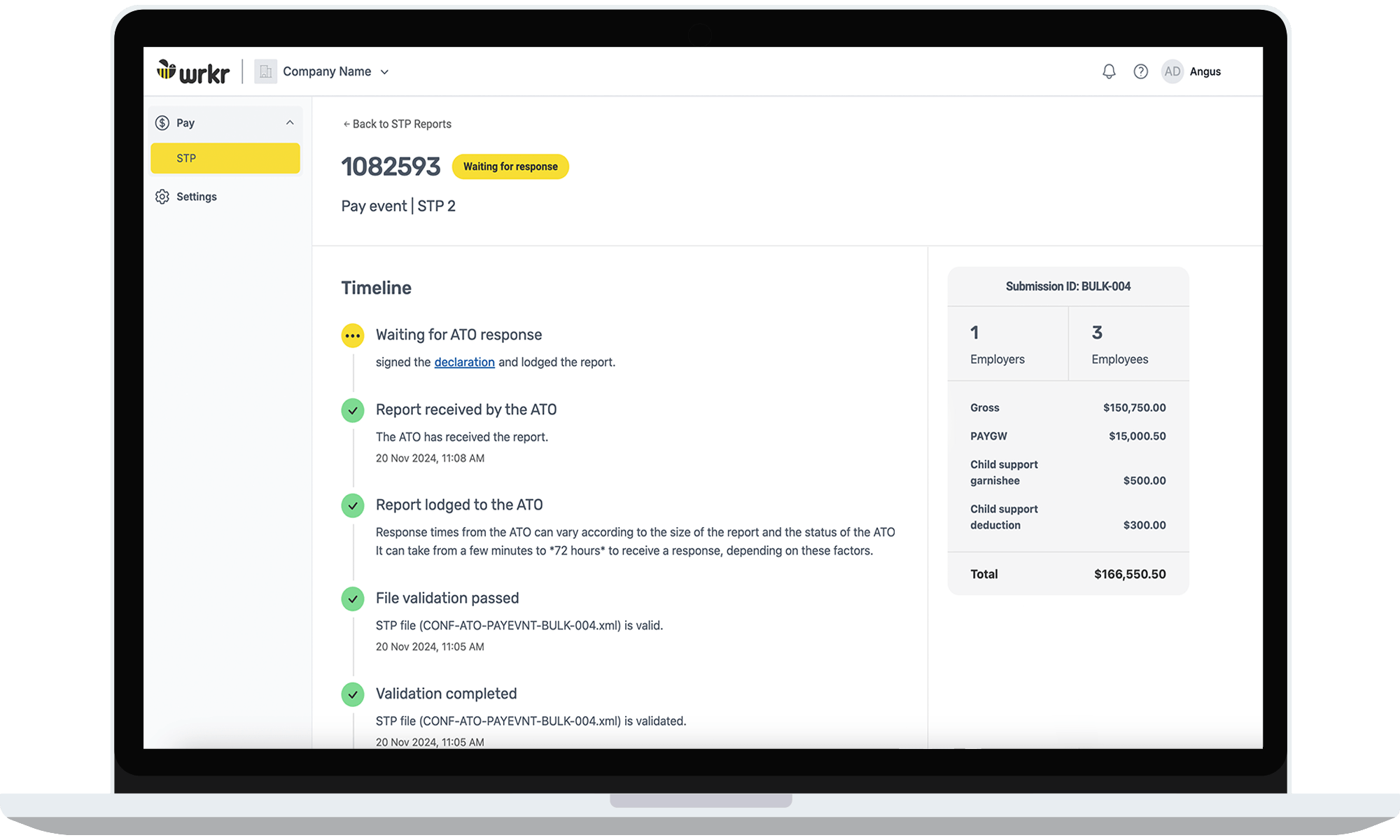

submit payroll data to the ATO at each pay run, eliminating the need for year-end summaries and reducing compliance risk.

Seamless Integration

Our STP solution can integrate smoothly with your existing payroll systems, ensuring a seamless transition and minimising disruptions to your workflow.

Automatic Updates

Stay compliant with the latest STP regulations and updates with no additional effort. Our service is designed to adapt to changes in legislation, keeping your business protected.

Comprehensive Support

Our dedicated support team is here to assist you every step of the way, providing guidance and resources to help you navigate the STP landscape.

Why Choose Wrkr for STP?

Essentials for STP Processing via Wrkr

01

For Employers – A STP compliant file

Employers securely upload STP reports from your payroll solution that has been whitelisted by the ATO.

02

For Digital Service Providers (DSPs)

Wrkr is an accredited ATO Sending Service Provider with flexible integrations to your payroll solution. Wrkr facilitates secure end to end STP reporting compliance with the ATO.