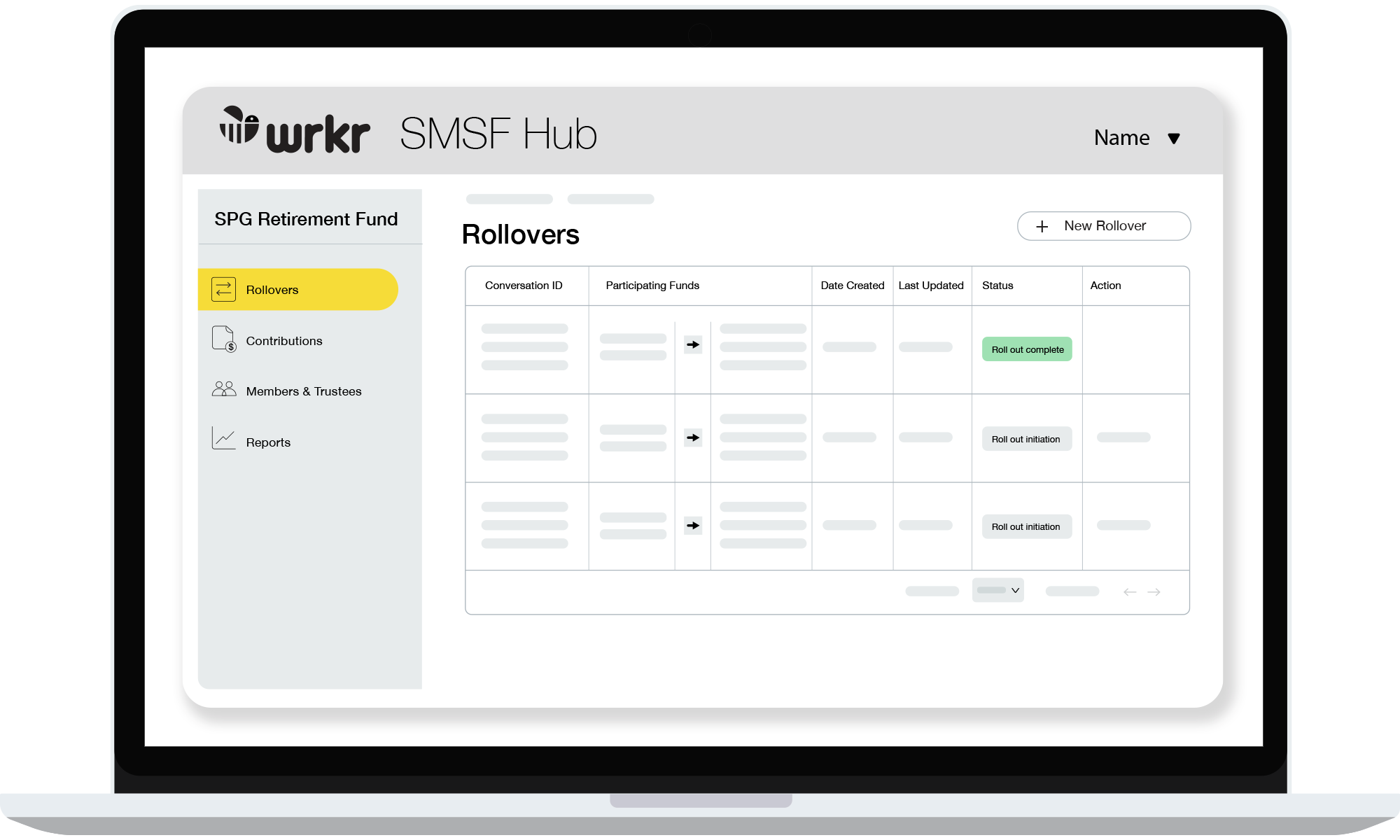

Wrkr SMSF Hub

Manage your SMSF Rollovers, Contributions and Release Authorities in one platform.

Why is Wrkr SMSF Hub the right service for you?

Registered SMSF SuperStream Messaging Provider

SuperStream Rollover 3.0 Compliant

Easy to setup

Centralised and secure data storage

What you can do with Wrkr SMSF Hub

For Trustees

- Get your Electronic Service Address (ESA) instantly

- Securely perform rollovers to and from any APRA funds or other SMSFs

- View contribution data and action release authorities

- Download contribution and rollover reports for your advisers, accountants and auditors

Advisors & Accountants

- Get an Electronic Service Address (ESAs) for your SMSF clients instantly

- One easy login to add multiple SMSFs to your account and manage their ESA compliance

- Securely perform rollovers to and from any APRA funds or other SMSFs

- Get a complete view of SMSF members’ contribution data

- Receive release authorities notifications from the ATO and action them

- Download contribution and rollover reports for each of the SMSFs you have added to your account

Take action

What our customers say

”I am really proud that we implemented Wrkr SMSF and became compliant with SuperStream requirements before the ATO deadline. We have set up a much faster process and have peace of mind knowing we are following the new regulations.

Sonia AmbwamiHead of Administration - Financial Services at UGC

Frequently asked questions

What is an Electronic Service Address (ESA)?

An Electronic Service Address (ESA) is an alias used by your SMSF that represents the provider to which SuperStream data should be sent – it is not a number. SuperStream data is sent electronically and consists of contribution, rollover and release authority messages.

Wrkr is a provider of ESA services and is compliant to process all SuperStream data for SMSF SuperStream compliance. An ESA is only related to the SuperStream data part of the process, not payment processing. For any queries relating to contribution payments, your employer is the best party to seek assistance from.

What information do I need to set up my SMSF ESA with Wrkr?

You will need the following information:

- Full name

- Australian business number (ABN) to receive and transfer your superfunds

- Email address

- Australian mobile number

- Credit card or direct debit payment details

I have registered for my Wrkr ESA. What happens next?

- You will be issued your ESA

- Update the ATO with your new SMSF ESA details

- Update your software ID (SSID) with the ATO

- Update your employer with your ESA so that you can receive contribution data (if applicable).

There are multiple members in my SMSF. Do all members need to register for an ESA?

Only one registration per SMSF ABN is required; all members can use the same ESA.

After registering your SMSF for the Wrkr ESA, all members/trustees provide the same ESA to their employers.

Once I have a Wrkr ESA, can I use it for a Rollover?

Yes. Your Wrkr ESA will be ready for a Rollover once you have updated the ATO with your new details (see above). Rollovers within SuperStream support the following scenarios:

- Transactions between an APRA superfund and an SMSF

- Transactions between an SMSF and an SMSF.

What is a Release Authority?

A release authority is specific written authority from the ATO authorising the release of superannuation from a complying superannuation fund.

The following release authority types are supported within the SuperStream:

- First home super saver (FHSS) Scheme

- Excess concessional contributions (ECC)

- Excess non-concessional contributions (ENCC)

- Excess non-concessional contributions tax

- Division 293 tax due and payable

- Division 293 tax deferred debt

How do I contact the Wrkr SMSF Hub?

For assistance and general enquiries, please click the link here SUPPORT