Super Funds

Your gateway to the future of employer and employee experience by connecting super funds with Employers and the ATO.

Payday Super is Coming. Are You Ready?

The ATO’s Small Business Superannuation Clearing House (SBSCH) closes on 1 July 2026. If you currently use it to manage super payments, you need to switch to a new system before then.

Wrkr is ready for Payday Super. Register now for early access.

Wrkr brings more than 15 years of operational experience connecting super funds with employers and the ATO

We provide superannuation clearing house, gateway and onboarding solutions to simplify employer compliance, streamline the member onboarding experience and significantly increase the data quality for super funds.

Clearing house solutions

Member onboarding

Super Stream Gateway

Integrations & additional services

01

Support for all payment types and reconciliation

02

Under our AFSL or yours

03

Full support for KYC Compliance and AML compliance

Clearing House

The clearing house is becoming a critical point of interaction that your fund has with employers on a day to day basis.

Wrkr streamlines employer-to-fund processing and fund-to-fund transactions, offering automated reconciliation and customisable validation to alleviate the administrative burden of meeting legislative requirements.

We prioritise the security of your members’ data. Our clearing house employs advanced encryption protocols and stringent access controls to safeguard sensitive information, ensuring compliance with regulatory requirements and industry standards.

Wrkr’s clearing house validates data digitally and in real time, delivering funds significantly improved data quality, meaning less errors and reduced processing costs.

Seamlessly integrate our clearing house with your existing systems and workflows. Whether you prefer API integration, file uploads, or manual entry, our solution adapts to your preferences, minimising disruption to your operations.

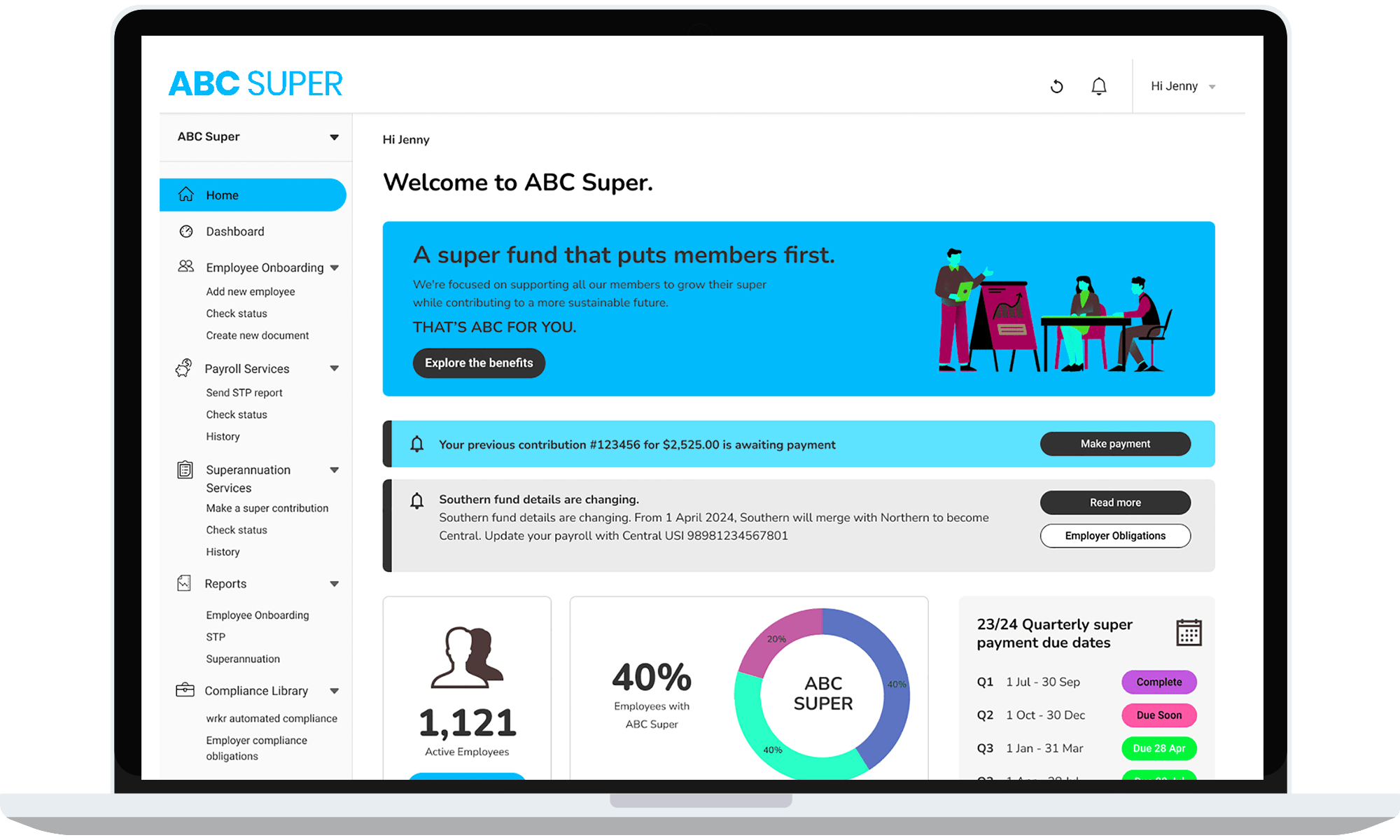

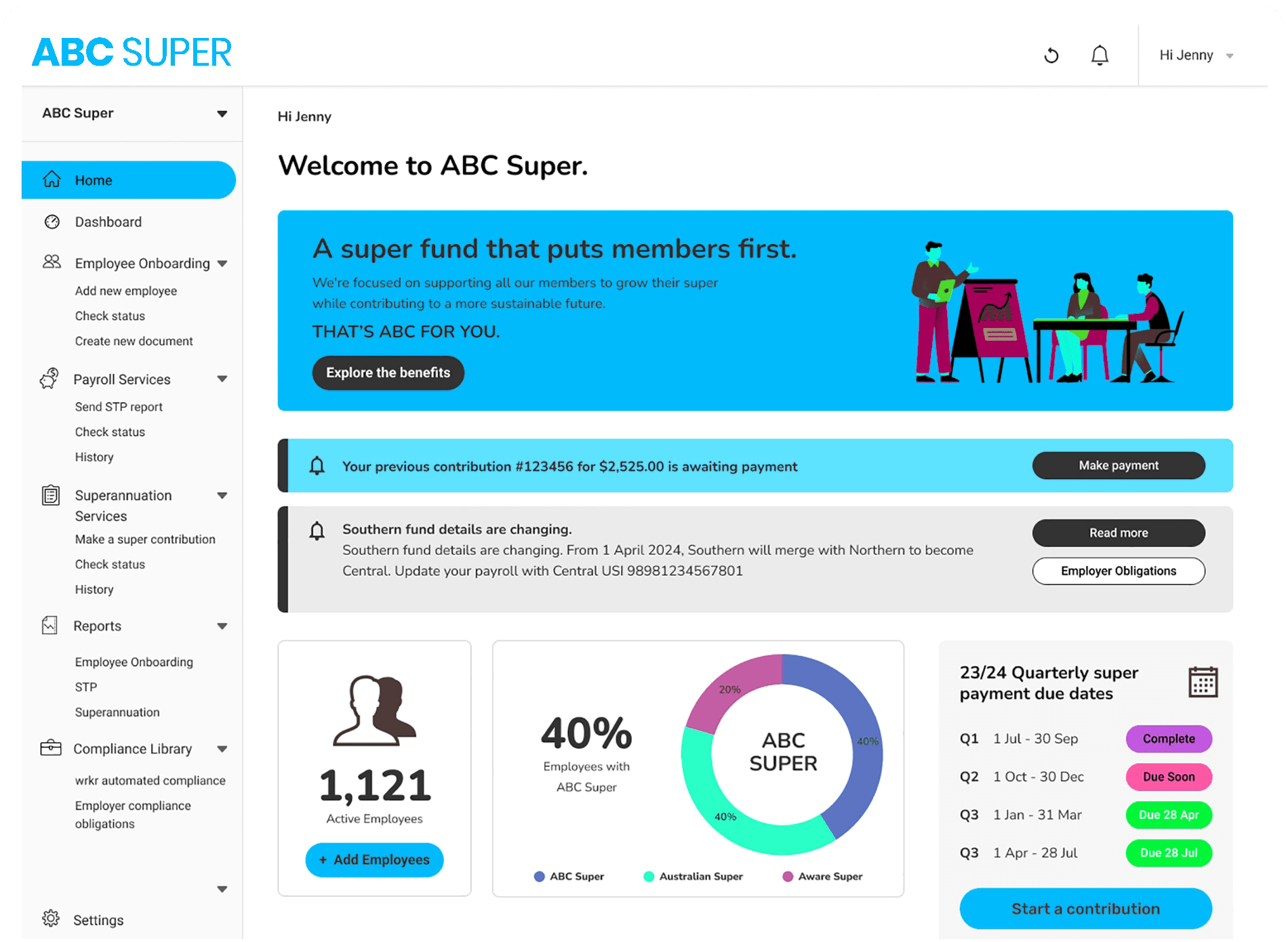

The Wrkr platform for all Super Funds

Wrkr offers a fully digital online platform, ensuring quicker and more efficient services for funds, their members, employers, and payroll providers.

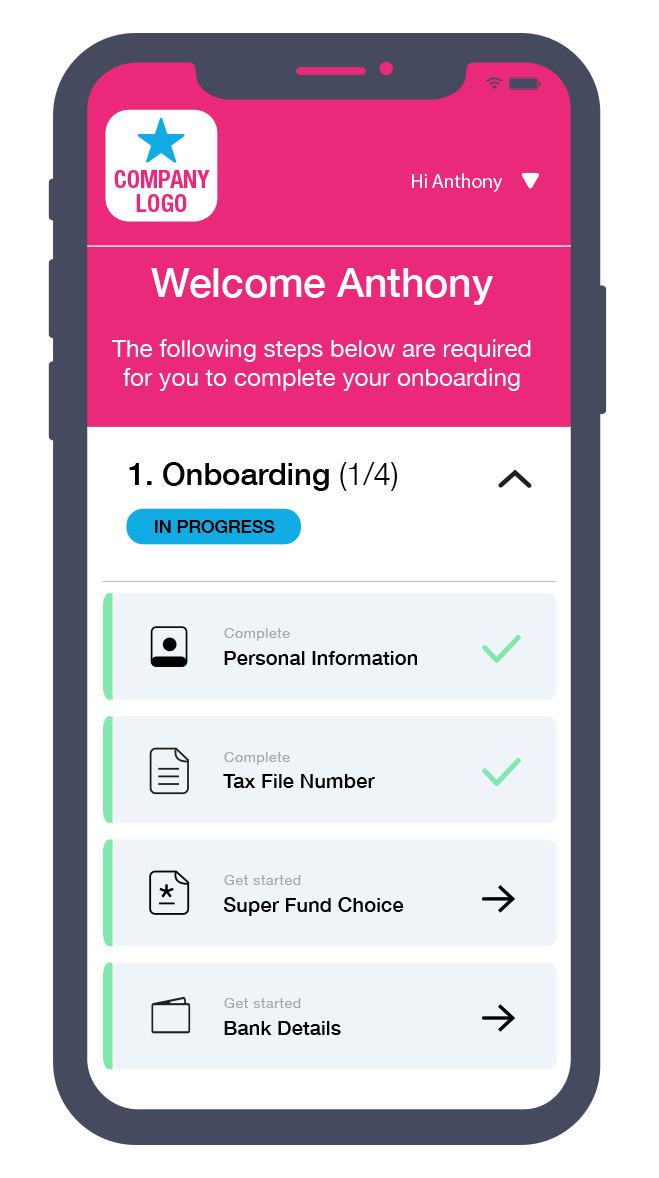

Employee Onboarding & Stapling

Wrkr makes onboarding employees simple and keeps employers compliant with stapling and choice legislation.

Seamless Onboarding

Super funds benefit from Wrkr’s simple onboarding process for new employees when choosing their superannuation fund. Our intuitive interfaces and direct connectivity back to your administration system enables an employee to join your fund or find their existing member number in real time* whilst remaining compliant with the SIS act.

Stapling integration

Wrkr seamlessly integrates with the Australian Taxation Office’s (ATO) stapling process, enabling employers to find their employee’s existing super accounts with ease. This integration eliminates the hassle of duplicate accounts and reduces the administrative burden on your employers.

Configurable Workflows

We understand that every business has unique onboarding requirements. That’s why Wrkr allows employers to tailor the onboarding experience according to their specific needs. Whether it’s custom forms, documentation requirements, or communication preferences.

Data Security & Compliance

A highly secure api-first solution which utilises multifactor authentication, standards driven messaging and data encryption at rest. Employers can configure user access controls for further security and data privacy. Ensure your employers and their employee data is always secure when sharing appropriately to systems to meet both regulatory requirements and consumer data rights consent.

*Real time find and join available where Wrkr is integrated with the fund’s administration system.

Win new or retain existing members with employer branded onboarding with clear presentation of your fund as a default/choice option.

SuperStream Gateway

Wrkr takes care of all your SuperStream requirements in one place, including gateway, MAAS and MATS.

Our SuperStream gateway simplifies and automates the process of superannuation reporting to the ATO, reducing the administrative burden on superannuation funds and their employers.

Our gateway service acts as the central hub for seamless communication and data exchange between various stakeholders within the superannuation ecosystem. Designed to streamline interactions and transactions, our gateway offers a range of features to enhance efficiency and connectivity.

Compliant and secure data exchange safeguarding information and mitigating risks.

Our secure API validates data as its taken in to minimise errors around superannuation reporting, leading to more accurate, timely records and compliant with regulatory requirements.

Wrkr’s Gateway facilitates smooth and efficient data exchange between super funds, employers, and payroll providers. Whether it’s contribution data, member information, or compliance updates, our platform ensures that data is transferred securely and in real-time, minimising delays and errors.

Boosting efficiency through automation: our Gateway service acts as the central hub for seamless communication and data exchange between various stakeholders within the superannuation ecosystem. Designed to streamline interactions and transactions, our Gateway offers a range of features to enhance efficiency and connectivity.

Integrated Connectivity: With Wrkr’s Gateway, super funds can effortlessly connect with a network of employers and payroll providers. Our platform supports integrations with a wide range of systems and formats, allowing for seamless interoperability and reducing the need for manual data entry or reconciliation.

Customisable integrations: We understand that every super fund has unique integration requirements. That’s why Wrkr offers customisable integration solutions tailored to meet the specific needs of our clients. Whether it’s API-based integrations, file uploads, or direct connections, our Gateway adapts to accommodate diverse integration scenarios.

Integrations and additional services

Integrating into all the essential software, collecting and disbursing data to multiple systems securely and efficiently.

HRM/Onboarding

- Wrkr seamlessly integrates with HRM systems to pass employee data, ensuring accurate and efficient onboarding processes.

- Enable your employers to update their HRM system with verified compliance data in real time to streamlining administrative tasks and enhance data accuracy.

Payroll Integrations

- Our payroll integration APIs automate the collection of super contribution data from payroll systems, ensuring accuracy, reduced errors and compliance with regulatory requirements.

- Integration is supported by an immersive dashboard to handle errors and delivers greater insight into workforce compliance.

ATO/STN Compliance

- Wrkr ensures full compliance with ATO and Superstream requirements, enabling super funds to meet their obligations without fail.

- Our platform is fully integrated with the Superstream infrastructure, enabling secure and efficient electronic transactions between super funds and employers.

Compliance moments ecosystem

- Different industries have different compliance requirements. Wrkr continues to invest in solving these challenges in real time with the authoritative source of data and relevant industry regulators and peak bodies.

- Wrkr’s comprehensive compliance moments ecosystem provides super funds with a compelling competitive advantage in the market.